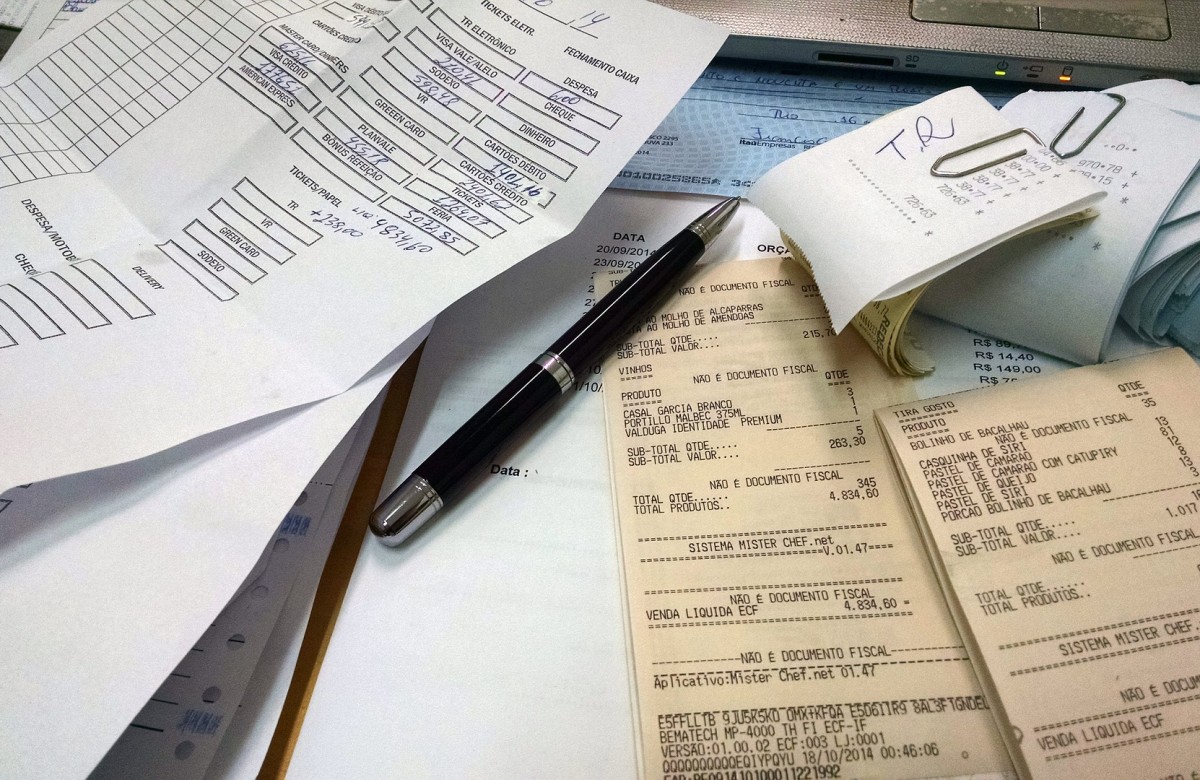

“I scan my receipts, can I toss the originals?”

The Canada Revenue Agency (CRA) requires tax documents to be kept for roughly seven years (we posted a note earlier with details on the retention period – click here to read it).

A common question is whether scanned documents are accepted as proof in the event of a tax audit. Electronic document retention has many benefits however, the CRA guidance on the acceptability of electronic documents is unclear (this article outlines the guidance: http://www.ledgerdocs.com/blog/are-scanned-documents-accepted-as-proof-in-a-canadian-audit).

A real concern for a taxpayer asked to produce an original receipt is that receipts often fade over time, particularly those printed on thermal paper. CRA, on the other hand, is concerned that scanned images can be altered. We therefore suggest:

- retain originals;

- scan receipts; and,

- keep supporting documents such as visa or bank statements.

Leave A Comment